A sluggish UK economy is expected to constrain construction activity

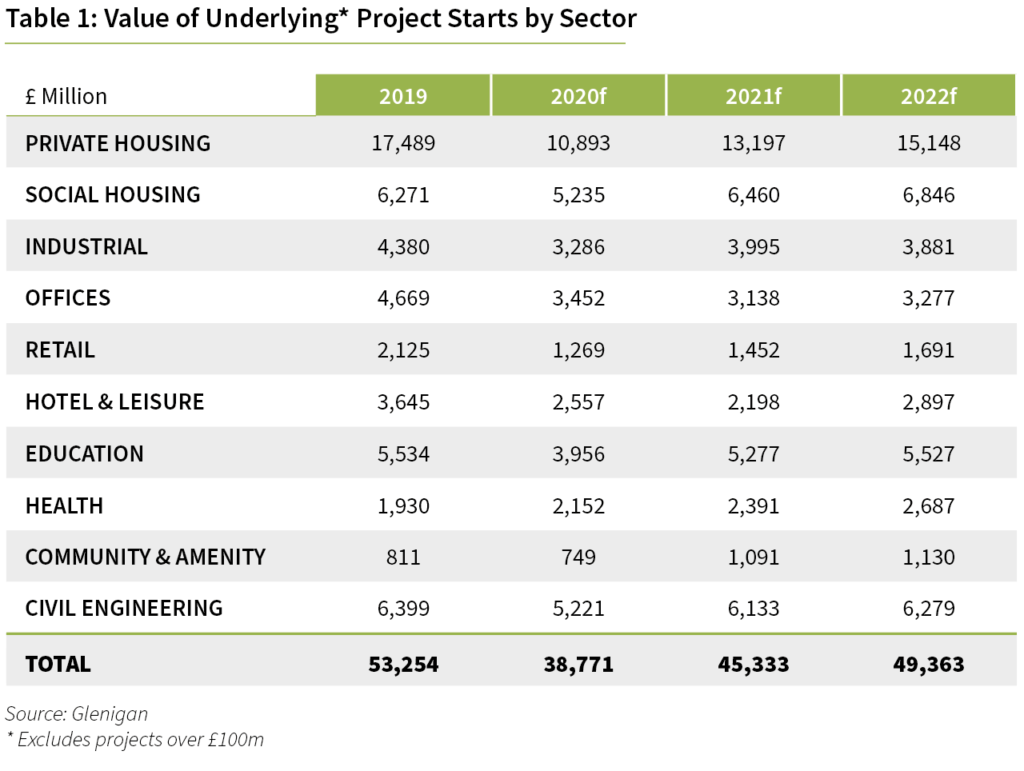

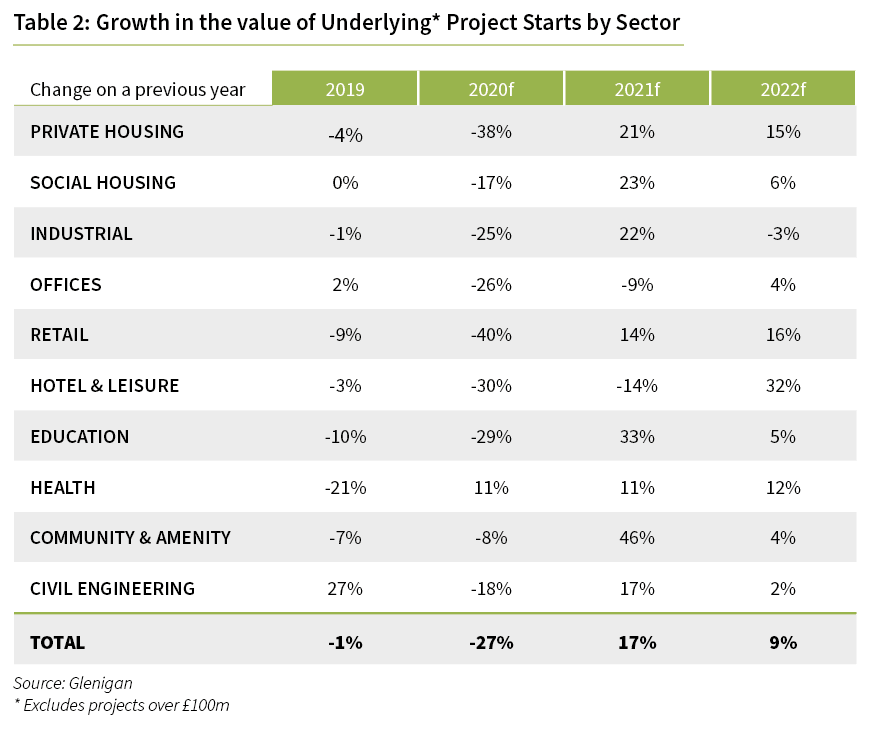

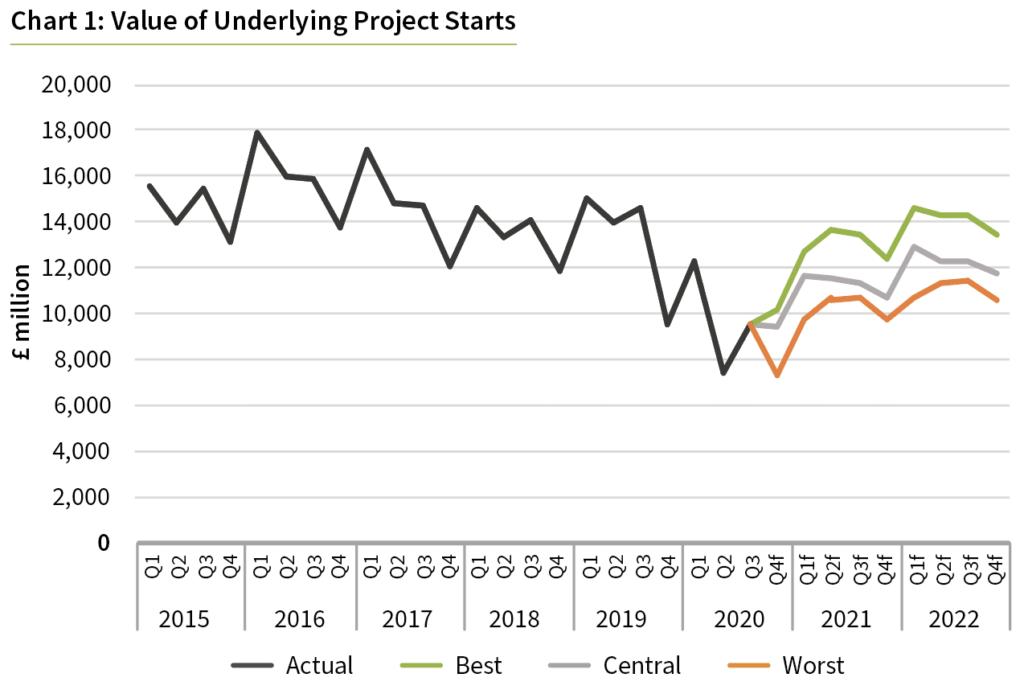

The COVID-19 pandemic and the lockdown of much of the UK economy from late March inflicted a massive external shock to UK construction. The value of underlying project starts (with a construction value of less than £100 million) dropped by 46% during the second quarter against a year earlier.

The second quarter marked the low point for the industry. In addition, whilst severe, the decline in quarterly starts was not as great as initially feared. Contractors were quick to adjust site working practices and suspended sites in England and Wales were re-opened more rapidly than initially anticipated, with a revival in new project-starts following in their wake.

Less than 3% of sites are still suspended and the third quarter has seen a sharp rebound in construction output and project starts. The value of underlying project starts rose by 19% during the third quarter, although they still stand 35% down on a year ago.

A more gradual, but sustained recovery is anticipated for the next two years; a period during which the UK economy will be gradually recovering from the COVID-19 pandemic whilst also facing Brexit related disruption to trade and growth. By 2022, the value of underlying starts is forecast to total £49.3 billion, just 3% below 2019 levels.

Given the exceptionally high-level of uncertainty over the outlook for the UK economy arising from both the pandemic and the UK’s future relationship with the EU, Glenigan has prepared two alternative illustrative scenarios in addition to their central forecast.

Weak economy curbs private non-residential work

A sluggish UK economy is expected to constrain construction activity over the forecast period, with private sector workload especially weak.

UK manufacturing faces weak domestic and overseas demand. In addition, UK manufacturers have less favourable access to the EU single market, increased administrative costs and potential disruption to EU source supply chains from next year. Against this background, Glenigan anticipate a continued weakening in manufacturing investment over the forecast period.

In contrast, warehousing and logistics premises are forecast to remain a growth area, bolstered by long-term growth in online retailing which is driving the demand for logistics space. Although growth in this area was initially disrupted by the Spring lockdown, the pandemic has accelerated the growth in online sales and this will help ensure the further expansion of warehousing and logistics activity during 2021 and 2022.

Whilst the pandemic has boosted the demand for logistics space, it has exacerbated the woes faced by more traditional retailing. In the retail sector, activity is forecast to decline as weak consumer spending and the growth in online retailing accelerate the restructuring of the retail industry and depress the demand for retail premises.

The leisure and hospitality industries are being especially hard hit by the pandemic. The collapse in the number of overseas visitors to the UK and the COVID regulatory restrictions on facilities’ operations have damaged the financial viability of many operating in the sector. Project-starts are estimated to fall by 30% this year and investor confidence will be slow to return to the sector.

Office starts have declined sharply this year as the lockdown has exacerbated a cyclical downturn in sector activity. Project-starts are forecast to weaken further during 2021 before improving in 2022. The sector will benefit over the forecast period by a rise in refurbishment projects as tenants and landlords adapt premises to accommodate changing working practices. In contrast, new build office projects are likely to be slower to recover as tenants and developers assess the impact of rising unemployment and potential structural shift in remote working on the long-term demand for office accommodation.

The national lockdown hit private housing activity especially hard during the second quarter. As suspended projects are re-opened, housebuilders have prioritised sites that are close to completion. The current ‘mini boom’ in the housing market is forecast to prove short lived with homebuyers’ confidence dented over the coming months by the poorer economic outlook and the recovery in project-starts is expected to be gradual over the forecast period.

Increased Government Investment

Greater public sector investment is expected to be a major driver for construction growth over the next two years, although the immediate priority of tackling pandemic and the deferral of the Spending Review to next year are likely to temper the increase in government capital funding.

Whilst the pandemic has caused a short-term hiatus in social housing starts this year, renewed growth is anticipated from 2021 supported by increased investment by housing associations. In contrast student accommodation work faltered during 2019, having been an important growth area for the sector in recent years. A further marked contraction in student accommodation work is expected this year, with only a limited recovery in this sub-sector during 2021 and 2022.

An increase in school building projects is forecast to drive a recovery in sector activity during 2021 and 2022 as local authorities tackle a shortage of secondary school places. An increase in further education work is also anticipated as FE colleges press ahead with approved projects. A fall in universities capital spending is expected to temper the overall growth in education sector work.

The outlook for the health sector is brightening, with promised increases in NHS capital funding expected to lift project-starts over the next two years. The Nightingale temporary hospital programme has bolstered project starts this year. Starts are forecast to maintain their upward momentum, rising by 11% next year and 12% in 2022 as NHS trusts develop and implement their investment programmes.

The Government has pledged to significantly increase investment in the UK’s infrastructure. While civil engineering project-starts, along with other sectors, have been disrupted and delayed by the lockdown, the sector is set to recover strongly over the forecast period.

Additional public sector funding is potentially available in areas such as roads. It may take time before additional projects are ‘shovel ready’. Therefore, Glenigan anticipate that, initially, the additional funding increases will be directed at starting smaller improvement schemes and areas such as tackling the maintenance backlog on the nation’s roads.

Existing major infrastructure schemes, including Thames Tideway, HS2 and Hinckley Point, are also forecast to lift civil engineering output over the forecast period. The £1.4 billion Stonehenge Tunnel is now scheduled to start in 2022, although important planning and contracting hurdles have yet to be cleared.