Market increases 3.8% in value to £5.35bn

Key Note has recently produced a comprehensive report on the UK market for windows and doors. Windows Active previews its content

One of the best and most comprehensive market reports for our sector is produced by Key Note. Its latest offering provides an exhaustive analysis of the UK market for windows and doors. The market, as examined in this report, covers the four main materials used within the industry: unplasticised polyvinyl chloride (PVC-U); wood; aluminium; and iron and steel. In 2014, Key Note estimates that the overall market grew by 3.8%, with growth of 4.9% recorded over the 5-year review period between 2010 and 2014. To a large extent, the market for windows and doors, both globally and in the UK, is dependent on construction output, with both the new-build and the repair, maintenance and improvement (RM&I) sectors accounting for significant markets. Construction output in the UK is now growing annually, following on from the 2008/2009 recession and subsequent economic downturn, when output fell dramatically. Key Note forecasts that the UK market for windows and doors will grow by 13.3% between 2015 and 2019, buoyed by rising output from the country’s construction industry, in addition to the anticipated new homes and public buildings which will need to be built to accommodate the UK’s expected annual population increases.

One of the best and most comprehensive market reports for our sector is produced by Key Note. Its latest offering provides an exhaustive analysis of the UK market for windows and doors. The market, as examined in this report, covers the four main materials used within the industry: unplasticised polyvinyl chloride (PVC-U); wood; aluminium; and iron and steel. In 2014, Key Note estimates that the overall market grew by 3.8%, with growth of 4.9% recorded over the 5-year review period between 2010 and 2014. To a large extent, the market for windows and doors, both globally and in the UK, is dependent on construction output, with both the new-build and the repair, maintenance and improvement (RM&I) sectors accounting for significant markets. Construction output in the UK is now growing annually, following on from the 2008/2009 recession and subsequent economic downturn, when output fell dramatically. Key Note forecasts that the UK market for windows and doors will grow by 13.3% between 2015 and 2019, buoyed by rising output from the country’s construction industry, in addition to the anticipated new homes and public buildings which will need to be built to accommodate the UK’s expected annual population increases.

According to Key Note, the UK market for windows and doors can be considered to be relatively robust, as such products are essential components in the vast majority of buildings. However, the market is considerably dependent on construction output, with fluctuations in the construction industry having a significant impact on it. At present, construction output in the UK is growing and, looking forward, it is apparent new homes and additional buildings will need to be constructed to meet the demand of the UK’s rising population. For the replacement market, the installation of double-glazed windows and doors has the potential to restrict future demand in the sector. However, tangible benefits to the market have been witnessed since the inception of the Green Deal, which has encouraged homeowners to upgrade components of their homes for both environmental and financial purposes.

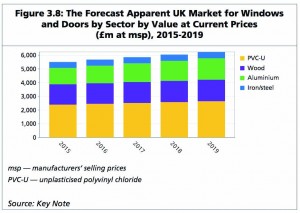

Key Note estimates that in 2014, the combined UK market for windows and doors was worth £5.35bn, which was an increase of 3.8% on the previous year, and represented growth of 4.9% over the 5-year review period between 2010 and 2014. Unplasticised polyvinyl chloride (PVC-U) represented the largest single sector in the overall market, with an estimated value of £2.33bn in 2014, comprising 43.7% of the total. Between 2010 and 2014, the sector grew by 1.2%. The second-largest sector was wood, which Key Note estimates was worth £1.46bn in 2014 (27.3% of the total). This was followed by windows and doors made from aluminium, which was worth an estimated £1.12bn in 2014, and those made from iron/steel, which was worth an estimated £434.2m.

Key Note forecasts that the UK market for windows and doors by value at current prices will amount to £6.24bn by 2019, a rise of 13.3% on the 2015 figure. Growth is forecast to be between 3% and 3.2% annually over the 5-year forecast period between 2015 and 2019. PVC-U will represent the largest share of the overall market in 2019, at £2.64bn (42.3% of the total), followed by wood at £1.57bn (25.2% of the total) and aluminium at £1.56bn (25% of the total). Finally, Key Note forecasts that the apparent market for iron/steel windows and doors will amount to £465.7m in 2019, representing 7.5% of the total. In the 10-year period between 2010 and 2019, Key Note forecasts that the overall market for windows and doors by value at current prices will grow from £5.1bn to £6.24bn, a rise of 22.4%. The report then moves its focus onto the import market. According to Government statistics, in 2013 the total value of windows and doors imports amounted to £490.3m. Broken down, the value of wooden windows and doors imports totalled £322.3m, with a further £71.8m accounted for by aluminium imports, £55.4m by unplasticised polyvinyl chloride (PVC-U) imports and £40.8m by iron and steel imports. Export figures were far lower, amounting to just £96.2m in 2013. PVC-U windows and doors accounted for the highest proportion of exports, at £30.6m. This sector was followed by iron and steel window and door exports, at £25.9m, and wood and aluminium variants, at £22.9m and £16.8m, respectively.

Main media advertising is then investigated, and a useful insight is produced. According to Key Note, in the year ending June 2014, main media advertising expenditure on windows, doors and conservatories amounted to £38.8m. Within the 12-month period, the largest spender was Everest at £13.2m. This was followed by Safetsyle UK with £12.6m and Anglian Group with £1.3m. Rounding out the top five were MPN UPVC Trade Frames and Advanced Group, which spent £1.2m and £908,000, respectively. The report further breaks down the spend and lists the top 57 advertising spenders in the UK. Overall the report provides a very informative analysis of the UK market for windows and doors. There are many positives that can be taken away from the report, and the signs are the market is moving in the right direction in terms of growth and opportunities. To obtain the full 95 page report priced at £575 please call:

Tel: 0845 504 0452

E: sales@keynote.co.uk