Good times coming for the window and door industry

The latest Builders Merchant Building Index (BMBI) report reveals builders’ merchants’ value sales in Q4 2023 were -5.7% down compared to Q4 2022, with volume sales falling -12.0% and prices rising +7.1%. With one more trading day in Q4 2023, like-for-like sales (which take the number of trading days into account) were -7.3% down.

The latest Builders Merchant Building Index (BMBI) report reveals builders’ merchants’ value sales in Q4 2023 were -5.7% down compared to Q4 2022, with volume sales falling -12.0% and prices rising +7.1%. With one more trading day in Q4 2023, like-for-like sales (which take the number of trading days into account) were -7.3% down.

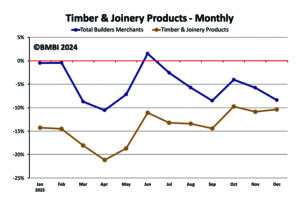

Year-on-year, half of the twelve categories sold more in Q4 including Workwear & Safetywear (+8.6%) and Decorating (+7.1%). However, the three largest categories all sold less: Landscaping (-6.7%), Heavy Building Materials (-7.3%) and Timber & Joinery Products (-10.3%).

Quarter-on-quarter, total value sales for Q4 were down -15.7% compared to Q3. Volume sales fell-19.8% while prices rose +5.1%. With four less trading days in the most recent period, like-for-like sales were -10.1% lower. Workwear & Safetywear (+17.0%) and Plumbing Heating & Electrical (+4.4%) were the only two categories to sell more.

Rob McGlennon, Managing Director of Deceuninck UK is BMBI’s expert for Windows & Doors, comments: “What will happen to the window and door industry in 2024? It’s easy to get depressed by bad news and talk the market down. But if you look there’s also a lot of positive news, What are the forces at play?

“Regardless of your political leaning, the Government is likely to change in the next 12 months, bringing fresh eyes and enthusiasm. A new Government must be seen to address the big problems, including housing. Young voters are feeling disenfranchised. Home ownership is out of reach for many young voters who are forced to live with parents or friends or in shared accommodation at high rents. Many are Labour voters who expect a new Government to put housing at the top of its to do list.

“In a new Financial Times analysis heavyweight forecasters say England needs 500,000 new homes a year to keep up with the country’s rising population, far more than either main party has pledged to deliver, and far more than the industry ’s capacity to build. The industry is looking to Government for a reduction in weather-vane politics to give them the confidence to invest in additional capacity. A population boom from record levels of migration, rising domestic demand and a historic undersupply has raised latent demand. Over 20 years, governments have failed to build the target of 300,000 new homes a year, and the backlog is growing. “We need to be aiming higher, ”says Paul Cheshire professor emeritus at the London School of Economics. “The prospects for RMI also look strong, driven largely by the need to upgrade the energy performance of Britain’s housing stock.

“Despite news that the UK economy entered recession at the end of 2023, technically or for real, consumer confidence is increasing. Falling inflation and food prices have lifted spirits, and the smell of change is in the air. GfK’s Consumer Confidence Index climbed three points to -19 in January 2024, the best it’s been in two years. Better still, consumers’ personal financial index, their willingness to spend, improved to zero after 24 months of negative scores. According to Savills, the over 65s held a record £2.2 trillion in mortgage free housing wealth last year. There are good times coming for the window and door industry.”