Monthly price rises a feature for construction products

Data from the Office of National Statistics (ONS) showed month-on-month prices rises for PVC-U windows and doors in 2023. For most months during the year these increases were above the overall trend for rises in all products across the repair, maintenance, and improvement sectors. Products in the PVC rigid pipe sector rose significantly in March 2023 and then settled to monthly increases below those witnessed for PVC-U windows and doors, and then witnessed a smaller spike in October 2023. This price inflation has been a characteristic of the wider market for construction products. Noble Francis is the Economics Director at the Construction Products Association and provides expert commentary on sector data. He explains: “Materials price inflation has continued almost 18 months on from the spike in energy and commodity prices that led to materials price inflation peaking at 26.8% in June 2022.”

Data from the Office of National Statistics (ONS) showed month-on-month prices rises for PVC-U windows and doors in 2023. For most months during the year these increases were above the overall trend for rises in all products across the repair, maintenance, and improvement sectors. Products in the PVC rigid pipe sector rose significantly in March 2023 and then settled to monthly increases below those witnessed for PVC-U windows and doors, and then witnessed a smaller spike in October 2023. This price inflation has been a characteristic of the wider market for construction products. Noble Francis is the Economics Director at the Construction Products Association and provides expert commentary on sector data. He explains: “Materials price inflation has continued almost 18 months on from the spike in energy and commodity prices that led to materials price inflation peaking at 26.8% in June 2022.”

However more recently it has been falling as Noble points out: “Materials inflation has been falling for 6 consecutive months as a slowdown in housing new build and improvements led to falls in construction materials demand. Looking forward, subdued house building and improvements demand will continue to lead to deflation but may be offset by price increases in some products on 1 January as winter rises in energy costs feed through and some product imports fall in winter, especially where prices have fallen sharply such as timber. As the rate of materials inflation has been falling, it is unsurprising that materials prices on a monthly basis have been falling for seven months but prices remain at high levels and in November 2023 materials prices were still 38.5% higher than in January 2020, pre-pandemic. This continues to have cost implications for fixed-price projects signed up to years before, especially for smaller specialist sub-contractors, particularly those also under pressure from some major house builders and main contractors to cut prices. Hence, why construction insolvencies are at their highest level since the financial crisis.

“Although construction materials prices fell by 2.3% in the year to November, the prices of some materials are still rising whilst the prices of other materials are falling so how house builders and contractors find the impacts of the changes in construction materials prices on their cost base will clearly depend on the product-mixes that they are using. The fastest construction materials price rises in the year to November were in Doors and Windows (17.5%), Ready-mixed Concrete (14.6%), Kitchen Furniture (12.2%), Pre-cast Blocks (8.7%) and Electric Water Heaters (6.0%).

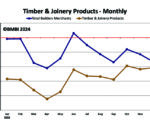

“The sharpest falls in construction materials prices in the year to November were primarily in steel-related products such as rebar (-24.4%) and fabricated structural steel (-22.0%) as well as timber-related products such as aggregates (-12.4%), imported softwood (-12.0%) and imported plywood (-8.2%).”

The comparison to other sectors is very revealing and enables a better understanding of how particular trades can adjust their prices. James Edwardson of home improvement specialist Living Dreams told Windows Active: “We have experienced differing rates of price rises from different suppliers in 2023. We operate across a wide spectrum of products including windows, doors, kitchens, and extensions. We have been subjected to annual rises of between 10-20%. It is really important that our prices to our end customers incorporate these rises. Fortunately, we have a good local reputation and our customers are looking for quality and not just the cheapest price.”