Market Data

Fenestration sector sees ‘flight to quality’ as efficiency searches dominate amid economic headwinds

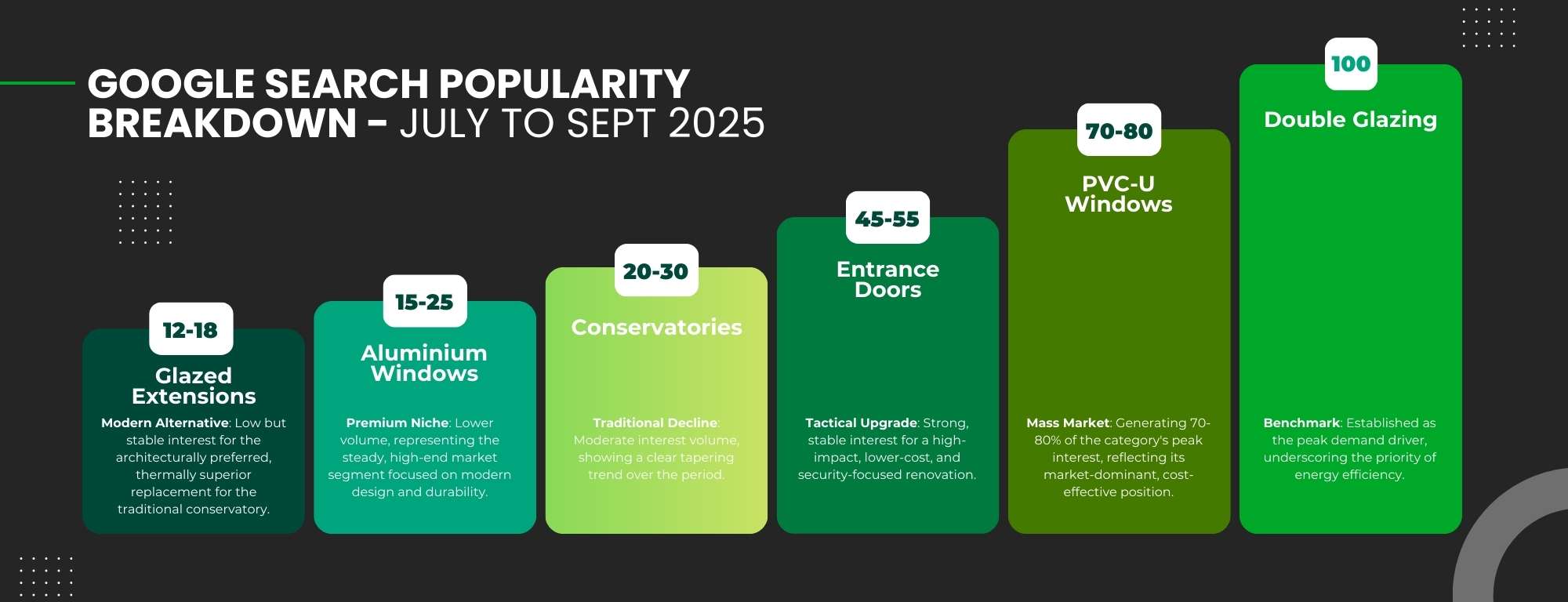

The UK’s fenestration industry is navigating a phase of cautious consumer spending, with recent Google Trends data over the last three months revealing a market adjusting to persistent economic headwinds. Analysis of key search terms suggests that while demand remains, homeowners are prioritising investments that offer demonstrable returns on energy efficiency and aesthetic value, rather than large, discretionary structural expansions.

Searches for “double-glazing” (Index 100) have served as the anchor for the sector, maintaining robust volumes that underscore the enduring consumer preoccupation with thermal performance. This consistent interest, which sets the benchmark at 100 for the category’s peak popularity, reflects the sustained impact of elevated energy prices, compelling householders to view window upgrades less as a luxury and more as a necessary utility cost mitigation strategy ahead of the winter months. The search data suggests a ‘Flight to Efficiency,’ where consumers are focused on fundamental fabric improvements that deliver immediate financial savings.

The analysis also points to a continuing evolution in the extension market. Search interest for traditional “conservatories” (Index 20-30) is exhibiting a gradual decline across the period. In contrast, the more contemporary term, “glazed extensions,” shows relatively stable interest at a lower Index of 12-18. This shift indicates a market preference for structurally superior, thermally efficient, and architecturally integrated glass living spaces, aligning with higher-value projects that appeal to those less affected by the cost-of-living squeeze.

The battle of materials remains sharply defined. “PVC-U windows” continue to generate the highest search volume at an Index of 70-80, confirming its position as the high-volume, accessible solution for budget-conscious homeowners. This represents 70-80% of the sector’s peak search interest. However, while smaller in volume, searches for “aluminium windows” (Index 15-25) have remained stable, supporting the narrative of a bifurcated market. Aluminium appeals to the premium segment, where the focus is on achieving slim sightlines, modern aesthetics, and superior durability, confirming that pockets of high-value discretionary spend persist.

Crucially, “entrance doors” have shown resilient, steady search activity at an Index of 45-55. This product category represents a high-impact, lower-outlay investment compared to full window replacements or extensions. The strong interest here suggests homeowners are opting for impactful, relatively affordable upgrades that enhance curb appeal, security, and immediate thermal benefits without committing to the multi-decade debt of a major renovation.

For fenestration businesses, the data suggests a need to sharpen messaging around Return on Investment (ROI) and immediate thermal benefits. The companies that successfully pivot to high-performance, energy-rated products and provide compelling financial arguments for essential upgrades, particularly in the premium and security-focused entrance door markets, are best positioned to thrive as the industry adjusts to a more discerning and economically cautious consumer base.