Sluggish construction-starts tempered by surge in planning approvals

Construction industry insight and intelligence expert Glenigan has released the November 2023 edition of its Construction Review.

The Review focuses on the three months to the end of October 2023, covering all major (>£100m) and underlying (<£100m) projects, with all underlying figures seasonally adjusted.

It’s a report which provides a detailed and comprehensive analysis of year-on-year construction data, giving built environment professionals a unique insight into sector performance over the last 12 months.

The November Review highlights consistently weak construction-start performance as the industry navigates a tough economic landscape.

Averaging £5,541 million per month, project-starts plummeted 27% against the preceding three months’ performance, to stand 59% lower than a year ago.

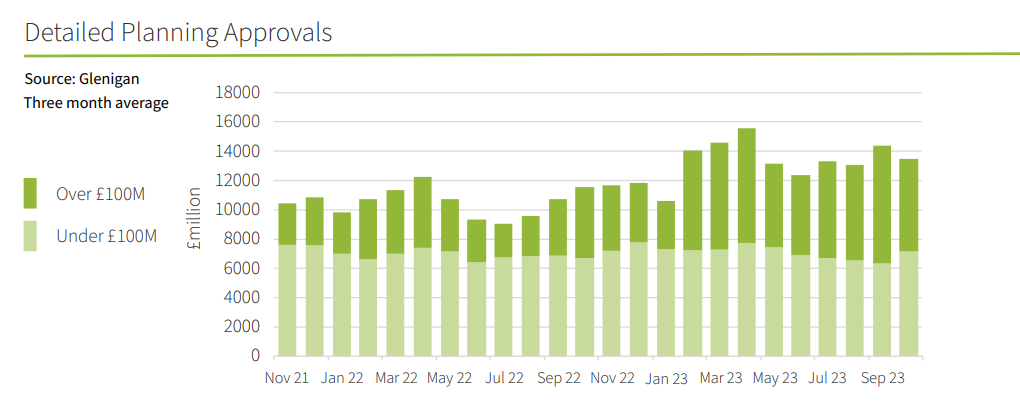

Main contract awards were also sluggish, dipping 27% in the run-up to November and down 51% on 2022 figures. However, detailed planning approvals registered a modest 1% increase in the three months to the end of October, growing 17% against the previous year.

Commenting on the Review, Glenigan’s Economic Director, Allan Wilen says, “This underwhelming performance is symptomatic of a number of external constraints on the UK construction industry. High interest rates and a persistently sluggish economy are continuing to depress consumer and investor confidence, resulting in lower levels of activity across most of the private sector.

“The downturn in public sector project-starts is particularly concerning, pointing to ongoing challenges for government departments in prioritising capital projects, despite a significant rollover of capital underspends from the previous financial year.

“Nevertheless, our recent Construction Forecast anticipates industry recovery in 2024, with starts expected to grow 8% next year. Furthermore, the recent surge in planning approvals offers a small glimmer of hope, with the potential to provide plenty of opportunities for agile contractors over the coming years.”

The sector-specific and regional index, which measures underlying project performance, paints a picture of general decline. Project starts across every vertical plummeted in the three months to October.

Underlying Sector Analysis – Residential

Overall residential starts-on-site fell significantly during the three months to October, dropping 23% during the index period to stand 30% lower than a year ago.

Drilling into the verticals, private housing was down 25% on the previous year, declining 22% against the preceding three months. Social housing also performed poorly, with work commencing on-site slipping back 30% during the three months to October and plummeting by 46% against the previous year’s figures.

Sector Analysis – Non-Residential

The value of starts fell across all non-residential sectors during the three months to October.

Industrial performance was disappointing, sinking 32% during the three months to October to stand 57% lower than a year ago. Retail lost ground as well, with the value of project-starts declining 3% against the preceding three months and 36% against the previous year.

Office starts were also on the decline, with the underlying value slipping back 8% against the preceding three months to stand 39% down on 2022 levels.

Health crashed, falling 43% against the preceding three months and declining 34% on the year before.

Education (-28%) and Community & Amenity (-5%) were both down against the preceding three months, standing 21% and 24% down on the previous year.

Hotel & Leisure experienced a poor period, declining on both the preceding three months (-57%) and the previous year (-68%).

Civils performance slipped back 18% against the preceding three months to stand 36% down on a year ago. Infrastructure starts dropped 15% against the preceding three-month period, remaining down 38% on the previous year’s figures.

The general decline in civils performance was partly influenced by poor utilities activity, with starts decreasing 22% against the preceding three months to stand 32% down on last year.

Regional Performance

Most parts of the UK experienced weak project-start performance during the three months to October. The West Midlands had a particularly poor period, with project-starts decreasing 27% during the three months to October and falling 43% against the year before.

It was a similar story in the Capital, with the value of project-starts decreasing 19% against the preceding three months and remaining 36% behind the previous year.

Performance in the South West (-7%) and the South East (-25%) was also lacklustre against the preceding three months, slipping back 29% and 25% against the year before.

The East Midlands fared even worse, where the value of project-starts fell 22% against the preceding three months to stand 44% down on a year ago.

The North East and East of England both experienced a weak period, decreasing by 31% and 34% respectively, remaining 21% and 31% down on last year.

Northern Ireland and Wales project starts also weakened, slipping by 45% and 21%, respectively, against the preceding three months, and down 52% and 23% compared to a year ago.

Scotland stumbled (-2%) compared with the previous three-month period, dropping 38% compared to the previous year. Yorkshire and the Humber, and the North West also suffered falls in project starts against both the preceding three months and previous year.